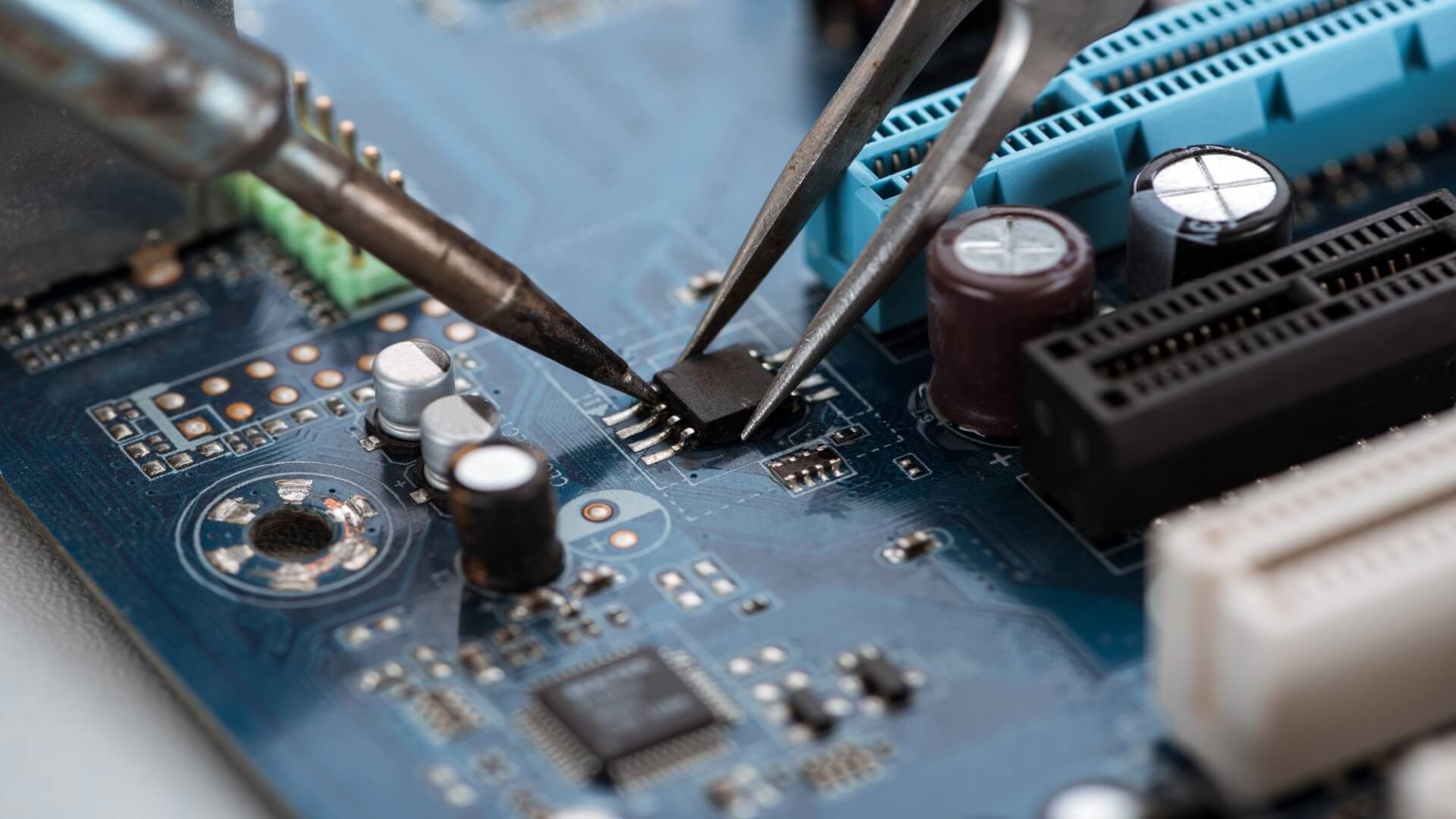

The US is looking at strategies to rebuild America’s semiconductor manufacturing. As recently as the 1990s, the US, where semiconductors were invented, produced 37% of the world’s supply of chips, but only about 12% of all computer chips are produced domestically now. In 2021, the decline in domestic chip production was exposed by a worldwide supply chain crisis that led to calls for reshoring manufacturing to the US. In the past two years, microchip shortages have highlighted America’s reliance on foreign suppliers for semiconductor manufacturing, and spurred passage of the CHIPS Act, which earmarks tens of billions of dollars as incentives for chipmakers to build new fabrication plants in the US. With the US government encouraging them, Intel, Samsung, Micron and TSMC unveiled plans for a number of new US plants.

The intent of the CHIPS Act is to increase the percentage of microprocessors produced in the US by closing the cost differential with countries such as Taiwan, South Korea, and China. Those nation’s governments are already subsidizing semiconductor manufacturers. The five major semiconductor producing nations including China, South Korea, Japan, Taiwan, and the US are also top consumers of the technology. It is important to note that China mainly manufactures mature chip technology, not the most advanced microprocessors.

Microchips are found in everything from industrial equipment and data centers to cars, smartphones, and gaming systems. And experts believe over the next decade, the biggest industries for semiconductor revenue will be servers, datacenters and data storage. They’re followed by smartphones, industrial electronics, the automotive industry, and personal computing. Here is an opinion piece we found of interest relating to the US and China in the semiconductor manufacturing industry.

The US Lead on Chips Was Secure for Years. Not Anymore

In an opinion piece “The US Lead on Chips Was Secure for Years. Not Anymore” for Bloomberg, Brooke Sample, editor, argues that while China has built a chip matching some of the West’s most advanced semiconductors, this should not come as a surprise to US defense experts and sanctions proponents, as industrial secrets are impossible to keep for long due to trade, theft and war. The progress toward parity with the West was revealed in a teardown conducted for Bloomberg News of the latest smartphone from Huawei Technologies Co., which utilizes a chip made by Shanghai-based Semiconductor Manufacturing International Corp. The Kirin 9000s chip is still two generations behind the most advanced Western products. At 7 nanometers, it will soon be outdistanced by the even thinner 3-nanometer chip that Apple Inc. will use in its next iPhone. Still, it reflects a porousness that lets knowhow slip through stringent US sanctions.

While it is possible that the Chinese are not yet able to make advanced chips in quantity or make the state-of-the-art semiconductors the West is already deploying in consumer products. She argues that it won’t be surprising if they get better, particularly if the government is raising $40 billion to support the domestic chip industry, as Reuters reports. The US can always tighten its sanctions against China and strengthen the safeguards to slow the proliferation. Read the full article on Bloomberg.

Disclosure: Fatty Fish is a research and advisory firm that engages or has engaged in research, analysis, and advisory services with many technology companies, including those mentioned in this article. The author does not hold any equity positions with any company mentioned in this article.

The Fatty Fish Editorial Team includes a diverse group of industry analysts, researchers, and advisors who spend most of their days diving into the most important topics impacting the future of the technology sector. Our team focuses on the potential impact of tech-related IP policy, legislation, regulation, and litigation, along with critical global and geostrategic trends — and delivers content that makes it easier for journalists, lobbyists, and policy makers to understand these issues.

- The Fatty Fish Editorial Teamhttps://fattyfish.org/author/fattyfish_editorial/January 19, 2024

- The Fatty Fish Editorial Teamhttps://fattyfish.org/author/fattyfish_editorial/January 3, 2024

- The Fatty Fish Editorial Teamhttps://fattyfish.org/author/fattyfish_editorial/January 3, 2024

- The Fatty Fish Editorial Teamhttps://fattyfish.org/author/fattyfish_editorial/December 31, 2023